The expert blog 0647

The Urban Dictionary Of True Solutions Financial

Everything about Digital Banking Solutions & Platform

Featuring a wide range of tools and performances that cover all aspects of these activities, it is now vital to successfully run their electronic change. It is utilized to deal with all operations from front as well as back workplace for all branches of the network on multiple networks: Net system, mobile application, Atm machines.

On top of its own modules, its open architecture enables link to software program from other providers. No matter the sort of business, the variety of individuals and also the volume of transactions, a contemporary core banking system is flexible enough to enable personalized arrangements and consequently reply to any type of particular requirement.

Furthermore, they are subject to the several and rigorous policies, with potentially hefty repercussions in situation of non-compliance. These pressures all market gamers to depend on an effective technological base. Many thanks to about two decades of commercial task, has ended up being a world-renowned online. We supply substantial remedies made up of greater than 200 components that sustain all tasks from back office to front workplace.

More About Best Digital Banking Platform In 2020

These latter for that reason delight in a multi-channel experience, having the ability to gain access to all financial solutions on their computer system or on a mobile digital device (phone or tablet computer). This adds to boost consumers' fulfillment and also helps retaining them, which is essential in a situation of increased competitors. Being a principal in the electronic financial area, we are devoted to offering banks and also banks with modern-day, reliable, trustworthy as well as flexible IT devices that can flawlessly meet their requirements.

It is finished by expert support in any way stages of the job application: analysis, combination, monitoring, introducing and also even after go-live. Furthermore, as a result of advancing market scenarios, our solutions are frequently being upgraded and upgraded with added functionalities. 450 professionals help our Research study and Development department to create software application with the ability of adapting to any type of considerable modification really rapidly (retail banking software solutions).

is widely renowned for its totally incorporated software application that aid financial institutions in building a remarkable multi-channel consumer experience. In this age where digital banking makeover is essential, having this software expert as a companion is vital to relocate in the direction of functional excellence as well as raise their end results. Versatility is one of SAB applications' largest advantages; for this reason, they cover all banking business lines.

Excitement About Digital Banking Software Solutions - Online Banking Software

Out of 577 unique financial institutions in the Philippines, 450 are rural banks that have a larger reach and scattered purposefully throughout the nation. Nonetheless, 94% of rural financial institutions have no access to an e-payment infrastructure. This implies most Filipinos do not have the means to obtain easier economic accessibility. Furthermore, most offered innovations and settlement remedies need an upgraded phone or a great wifi link that is not incorporated in the Filipinos' financial practices.

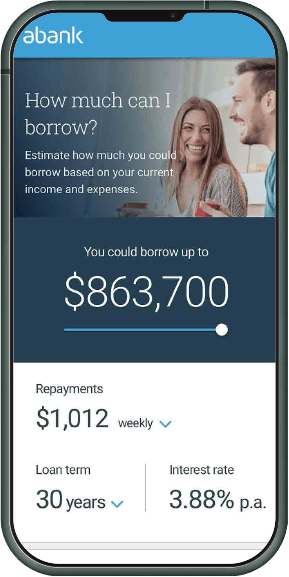

The depiction of monetary institutions is rapidly changing. No more is a financial institution an institution on Wall Street yet instead an application on my phone. Creating organization growth requires a rapid change to this service design. Our solutions resolve this transformation, enabling you to embrace new business sandstone perth models and specify a modern-day business architecture.

Welcoming electronic is a lot more than a mobile app, but instead an omni-channel method. You must map all of your consumer's wants and after that satisfy them. Younger customers often tend to be 'cashless' as well as want to transfer cash quickly with their good friends with mobile financial. Various other consumers expect personalized economic solutions and advice via an electronic banking platform.

Not known Details About Digital Banking Solutions & Platform

At the heart of this is trusted and secure solutions. The line of splitting up between affordable financial institutions, including digital native Fintech firms, is so narrow and also blurring even more yearly. Due to that, banking service producers can not manage a security slip. Consumers today will swiftly move services with one protection scare.

Our electronic and also application service experts will then make that roadmap a fact, designing and implementing new electronic services. Our end-to-end deals will electronically change your bank, handling risk and driving profitability.

Among the critical points when a business introduces a system whether a website or mobile app is opening user accounts that allow them to be used as pocketbooks, accelerating collections and allowing settlements and also transfers. Banking solutions Choices currently exist such as BBVA APIs Accounts as well as Home loans that mean, With the growth of ecommerce and also the digitization of society, has spread to all services.

What Does Digital Banking Solutions & Platform Do?

.jpg)

This digitization is changing payment services at all degrees of business, from multinationals to little as well as medium-sized enterprises down to the micro-SMEs coming from the freelance. From repayments to companies of items as well as solution to repaying the credit so typical of traditional regional stores, there is now a chance to digitize the "I'll place in on the tab" in a well organized method.

These systems aid by making it less complicated for swiftly and safely - digital broker solutions. first making use of charge card and after that via mobile banking solutions has actually been a historic barrier to entrance. The modern technology only began to be approved by the "bulks" in the phases in the item life process (innovators, very early adopters, early majority as well as late bulk) when the very early adopters reported that they were safe.

This assimilation depends upon the opening of a digital account within BBVA's electronic infrastructure, a significant factor in ensuring safety and security. With this API, a company's consumers can open up a electronic account with low monetary danger straight from that business's application or web site, without any demand for third events. As well as without leaving house.

Little Known Facts About Digital Banking Solutions.

Quick, safe and also with just a couple of clicks. BBVA's Accounts API helps business via the usage an API integrated into the BBVA environment, helping with the opening of accounts for clients, workers and providers with simply a few clicks. This includes offering customers the opportunity of connecting a debit card to the account.

When users wish to, they initiate a demand as well as obtain an SMS with an unique, one-time code, enabling them to trigger their brand-new account quickly and also safely. The agreement is sent to the consumer's email automatically. The new account can be administered using BBVA mobile financial, inquiring information of account details, viewing balances, as well as monitoring and also making movements.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

10 Tips For Making A Good Home Finance Software Australia Even Better

The earliest kinds of digital banking trace back to the introduction of Atm machines and cards launched in the 1960s. As the net emerged in the 1980s with very early broadband, electronic networks started to connect sellers with distributors and also consumers to establish demands for early on-line catalogues and supply software systems.

The enhancement of broadband as well as ecommerce systems in the early 2000s resulted in what resembled the contemporary digital banking globe today. The proliferation of smartphones through the following decade unlocked for purchases on the go beyond Automated Teller Machine. Over 60% of customers currently utilize their smartphones as the recommended technique for digital banking.

This vibrant forms the basis of client complete satisfaction, which can be nurtured with Consumer Relationship Administration (CRM) software. Therefore, CRM needs to be integrated into a digital financial system, because it offers means for banks to straight connect with their customers. There is a demand for end-to-end consistency and for services, enhanced on comfort as well as customer experience.

In order for banks to satisfy consumer needs, they require to keep concentrating on improving electronic modern technology that offers agility, scalability and also efficiency. A research conducted in 2015 exposed that 47% of lenders see potential to boost consumer connection with digital financial, 44% see it as a method to produce competitive advantage, 32% as a network for new customer procurement.

Major benefits of digital financial are: Company performance - Not only do electronic systems boost communication with consumers and supply their requirements faster, they also provide techniques for making internal features much more efficient. While financial institutions have gone to the forefront of digital technology at the consumer end for years, they have not completely embraced all the advantages of middleware to increase performance.

Conventional financial institution handling is costly, sluggish as well as vulnerable to human mistake, according to McKinsey & Firm. Depending on people as well as paper additionally occupies office, which runs up power and also storage space costs. Digital platforms can future decrease expenses via the synergies of more qualitative information and also faster action to market adjustments.

Coupled with lack of IT assimilation between branch as well as back workplace personnel, this trouble minimizes organization performance. By streamlining the verification procedure, it's easier to execute IT options with business software, leading to even more accurate bookkeeping. Financial accuracy is important for financial institutions to abide by government policies. Boosted competition - Digital services help handle advertising and marketing lists, permitting financial institutions to reach wider markets and build closer relationships with tech savvy consumers.

It works for executing client incentives programs that can boost commitment and also satisfaction. Greater dexterity - Making use of automation can quicken both outside and interior processes, both of which can boost customer fulfillment. Adhering to the collapse of monetary markets in 2008, an enhanced emphasis was put on threat monitoring.

Boosted protection - All companies large or little face a growing number of cyber threats that can damage track records. In February 2016 the Irs announced it had been hacked the previous year, as did numerous large technology business. Financial institutions can gain from added layers of security to protect information.

By replacing hands-on back-office procedures with automated software program remedies, banks can lower staff member errors and accelerate procedures. This standard change can lead to smaller operational systems and also enable supervisors to focus on enhancing jobs that call for human intervention. Automation reduces the demand for paper, which inevitably finishes up occupying room that can be inhabited with modern technology.

One means a bank can boost its back end business efficiency is to divide hundreds of processes into three groups: complete computerized partly automated hands-on tasks It still isn't functional to automate all procedures for lots of financial companies, especially those that perform financial testimonials or give investment advice. But the even more a financial institution can change cumbersome redundant guidebook jobs with automation, the extra it can concentrate on problems that entail direct communication with clients.

Additionally, electronic cash money can be mapped as well as made up more accurately in cases of disagreements. As consumers find an increasing variety of buying opportunities at their fingertips, there is much less need to carry physical money in their wallets. Other indicators that require for electronic money is growing are highlighted by the use of peer-to-peer repayment systems such as PayPal as well as the surge of untraceable cryptocurrencies such as bitcoin.

The problem is this technology is still not omnipresent. Cash money flow expanded in the USA by 42% in between 2007 and also 2012, with a typical annual growth price of 7%, according to the BBC. The idea of an all electronic cash money economic climate is no more simply an advanced dream yet it's still unlikely to date physical money in the future.

ATMs help banks reduce overhead, specifically if they are readily available at various strategic places beyond branch workplaces. Arising kinds of electronic financial are These solutions construct on boosted technical designs in addition to various service versions. The decision for banks to include more electronic remedies in any way functional degrees will certainly have a major effect on their monetary stability.

Sharma, Gaurav. " What is Digital Financial?". VentureSkies. Recovered 1 May 2017. Kelman, James (2016 ). The History of Banking: An Extensive Referral Source & Guide. CreateSpace Independent Publishing System. ISBN 978-1523248926. Locke, Clayton. " The tempting increase of digital banking". Banking Innovation. Gotten 9 May 2017. Ginovsky, John. " What actually is "digital financial"? Agreement on this oft-used term's meaning thwarts".

Gotten 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the financial institution's back workplace". McKinsey & Company. Retrieved 9 May 2017. Eveleth, Rose. " Will pay go away? Numerous innovation supporters think so, however as Rose Eveleth discovers, the truth is more complicated". BBC. Retrieved 9 May 2017.

Our cloud based remedy includes sector top safety, reducing your expenses as well as giving you assurance. This solitary platform advertises organic development with our huge collection of open APIs, function abundant capability as well as comprehensive reporting capabilities.

You can find more information about the topic here: sandstone characteristics

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

Think You're Cut Out for Doing banking app? Take This Quiz

Billtrust aims to accelerate the invoice-to-cash process, automate cash circulation, give a company's consumers much more flexibility and enhance organizational as well as functional efficiency. Gravity Payments PaymentsSeattleGravity Repayments is a settlement processing system for tiny services that features reduced prices and adaptable handling options. The firm's system enhances monetary purchase handling for everything from bank card to POS systems and also even present cards. Going out to dinner with a close friend as well as do not wish to split the bill with bank card or cash? Maybe you intend to pay your canine pedestrian with something other than a check? Venmo's application makes it very easy to transfer money from your checking account right into another users, so you can monitor settlements in real-time. Coinbase supports 32 countries and also has exchanged greater than$ 150 billion in different kinds of electronic currency, consisting of Bitcoin, Bitcoin Money, Ethereum and Litecoin. AcornsSavings, Investment, MobileIrvine, The Golden State Acorns is a financial savings and also financial investment mobile application. Linked to an individual's economic accounts, it spends change from acquisitions in a varied profile. RobinhoodStocks Menlo Park, The Golden State Robinhood is a financial investment application that allows users to invest totally free from a desktop or mobile tool. Since there are no.

physical areas or private account monitoring solutions, Robinhood aims to make investing available to prospective investors who can't rather swing the fees of a traditional brokerage house. The system settles and also handles all information across the investment globe, supplying a wider sight and allowing financiers to make even more educated decisions. AffirmLending San Francisco, California Affirm is a financing platform that permits individuals to pay for on the internet purchases in tiny installations. https://www.sandstone.com.au The firm offers passion prices as low as zero percent and also allows users to choose plans ranging from 3 to 36 months so they can pay with time for journeys, electronic devices, furnishings and also even more. Its items assist businesses take care of.

and track firm and also worker equity, manage portfolios and back office processes and also keep existing with SEC and also Internal Revenue Service guidelines. Ensured RateMortgages, LendingChicago, Illinois Surefire Price is a home loan provider and loaning service that uses electronic remedies to house buyers and those looking to refinance existing mortgages. Transunion Credit Rating Chicago, Illinois TransUnion began as a credit score coverage firm and also currently uses multiple monetary services as well as options for businesses, federal governments and people. Using data accumulated from numerous customers worldwide, the business provides deep info that helps customers, companies and organizations make much better economic choices. CommonBond Borrowing New York City, New York CommonBond jobs with students throughout their finance trip, from the get go of their university career to post-graduation refinancing. CommonBond additionally partners with.

Pencils of Guarantee to cover educational costs for children in the establishing world. CreditkarmaCredit Reporting San Francisco, The Golden State Credit Scores Karma deals individuals open access to credit rating, surveillance and also records, all absolutely free and as commonly as a user requires it. Utilizing this data, the site advises brand-new credit score opportunities, finances, car insurance coverage and also can even help dispute credit history report errors.

Fundrise is a system helps expand stocks-and-bonds-based profiles to consist of property investments. Although it includes loads of multi-million dollar real estate tasks, a starter portfolios call for only a$ 500 first investment. Kabbage Lending Atlanta, Georgia Kabbage supplies financing options for little services online. Because access to funding is a significant discomfort point to local business, Kabbage allows companies to expand by hiring more workers, increasing advertising and marketing or getting even more inventory. NerdwalletCredit Cards, Home Mortgages, Insurance, Car Loans San Francisco, California Nerdwallet offers a host of monetary tools as well as services, consisting of credit report card as well as financial institution contrast, spending how-tos, loan information and home loan guidance. The company's solutions assist customers browse the stuffed and often confusing worlds of money, investment, insurance policy as well as financial. NetspendPrepaid Cards Austin, TexasNetspend's products enable individuals and also businesses to manage cash via reloadable pre-paid cards.

Personal Capital SoftwareSan Carlos, California Personal Funding offers cost-free personal economic devices to aid customers take care of every one of their accounts in one area. The platform's dashboards show insights like web well worth, profile balances, account purchases, investment returns and also investing by account. The firm additionally helps with access to financial consultants. SoFiLoans, Wide Range Management San Francisco, The Golden StateSoFi gives refinancing, funding and also wealth management solutions.

Things like education, career as well as estimated capital are also part of the mix. Furthermore, SoFi uses advantages for which most institutions charge added or need large balances, consisting of career services, joblessness protection and also monetary recommending. Red Stripe Settlements, Software San Francisco, California Red stripe's net commerce platform supplies devices for markets, membership solutions, shopping companies as well as crowdfunding systems.

Wealthfront Investments Palo Alto, The Golden StateWealthfront is an automated investment option developed for millennials. Whether customers want to get a residence, take a year off to travel or prepare for retirement, Wealthfront assists them prepare for the future. The automatic investment device utilizes easy investing approaches to build a diversified profile and make best use of returns.

It powers leading markets and also firms like HomeAway, Evolve Holiday Rental Network and RentPath. Photos through social networks, Shutterstock and screenshots of firm web pages.

Now, you have an understanding that banking suppliers in the small as well as medium company market remain to make essential infant action in converting right into the digital globe. Nonetheless, this does not stop financial institutions from giving digital financial services. When there's a will, there's away. Therefore, there are lots of alternatives when it involves struggling SMBs that hold unpredictability concerning what's the most effective way to effectively bank.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

25 Surprising Facts About sandstone yatala

See This Report on Simple Steps For Increasing Digital Banking Adoption

Table of ContentsWant To Improve Online Banking? for DummiesProven Ways To Improve The Digital Banking Experience Things To Know Before You BuyHow To Get More Online Banking Customers - QuestionsIndicators on How To Get More Online Banking Customers You Should Know

Build anticipating models for feasible customer actions. Usage social media networks and online forums. As an example, on Reddit, you can post questions, chat with potential clients, as well as learn what their struggles are concerning electronic banking solutions. Target market analysis helps you identify vital information about their desires and also requirements which are necessary to recognize before establishing a financial institution.

It's an essential detail you definitely require to recognize before you begin a digital bank. Even more than that, you need to: Develop a list of requirements as well as a scoring system to examine your competitors; Study their strength as well as weak points; Discover what innovation they utilize and also how they market their items; Analyze what their clients consider their solutions, excellent or bad; Compare your digital banking suggestions to rival items.

An MVP is a version of an item that allows you to accumulate enough data in order to find out exactly how possible customers communicate with your item. In significance, it is a business concept concentrated on: Knowing just how consumers communicate with your item without needing to completely establish an electronic bank; Making corrections and also improvements at the early phases, while you have spent a restricted quantity of https://www.sandstone.com.au/en-au/cloud money, time, and also initiative; Making a decision whether your future item has possible (it prevails practice to reassess objectives or completely abandon a task).

Indicators on Want To Improve Online Banking? You Should Know

It's also not a Minimum Marketable Item (MMP) or Minimum Marketable Feature (MMF) since those are focused on earning and also not discovering. It would, in addition, be a blunder to focus on the "minimum" besides the "practical", when constructing a financial institution, because that will certainly not give you adequate information for analyzing whether consumers would certainly utilize your product.

Right here are the 4 most popular kinds of digital financial company versions. Aggregators distributing financial services from an ecological community of partners. If you make a decision to construct a virtual rely on this version, you will certainly: Minimize the prices of manufacturing the solutions. Offer more sort of solutions that a bank alone can't, including non-financial solution.

Open up systems open financial APIs; a technique that assisted in worth exchange, expands the customer as well as partner bases and also offers a lot more opportunities for acquiring funding. If you want to develop a count on this design, bear in mind that there are four primary platform financial versions: Proprietary: solitary sponsor and also solitary provides; APIs are used as a conciliator in between of developers (admit to information) and customers (give accessibility to the final item).

The Single Strategy To Use For Top Ways For Banks To Improve Customer's Digital Banking

Shared: lots of enrollers and lots of service providers; several companions manage the development process. Joint endeavor: several enrollers as well as single gives; a common interface that encourages partnership among sponsors (e. g., fintech companies). Banking as a Solution (BaaS) a cloud-based version where technology firms can operate as banks after obtaining suitable licenses.

g., legal representative or accounting professional solution); it entails hardware as well as a web server for interaction. Banking as a system (BaaP): a totally accredited platform or financial institution that various other companies use for supplying their solutions. Fintech SaaS: on-demand economic services given by means of BaaP; it additionally permits to plug in services supplied by various other banks (e.

Human as a solution (HuaaS): a behind the scenes, top layer that represents the services given by the Cloud employees. Traditional universal financial a design in which conventional banks develop a digital bank remedy (giving all or individual services). This is typically made to enhance customer care for customers that favor using the Web or don't have the time to be physically present in the financial institution.

The Ultimate Guide To Tips To Improve Digital Banking Experiences

Consequently, you need to study the legislations concerning banking as well as digital options in your country or the region you will distribute them in. Perhaps even seek advice from an attorney before you develop an online bank. Right here are some things to review up on thinking about when you make a bank in the digital environment: Digital signature a way of confirming an individual online; the extremely thing that makes on-line monetary services possible.

Digital atmosphere. The monetary system does not constantly develop as fast as the electronic atmosphere. You need to develop a virtual financial institution that will certainly allow your consumers to remain within the law. the brand-new demands for client verification which take impact in September 2019. the lawful framework you require to think about prior to starting a bank.

for managing top quality credit rating cards as well as resolving protection dangers. According to the criterion, you require to have multi-factor verification. controls information security in many various banks (around 1,500) and also banks, consisting of global ones. Just how to begin your own online financial institution when there is a lot competition? Is it smart to take on banks that already have a big customer base as well as can record their attention also stronger by producing on-line services? What startups fight with one of the most is getting distribution, prior to the recognized firms obtain development.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

What Will mobile banking Be Like in 100 Years?

You have the power to allow smooth links between your self-service channel and customers' tools. Vynamic Mobile is a next-generation mobile connection suite that offers you a modern, open approach to software application middleware and APIs. Neglect patches and screws. Currently you can release your software program flawlessly throughout channels, to link the dots as well as thrill your consumers.

Amsterdam, The Netherlands0031202101229Video asks for consumer sandstone home communication. They build a first-rate video calling technology to assist you connect with clients more easily. Arrange secure video clip telephone calls without downloads, likewise on mobile, as well as gather insights while remaining certified. Vancouver, BC877-2319422aeqbanking is a specialist in experience-driven banking. They assist financial institutions and also debt unions produce a competitive benefit by providing reliable and simplified experiences that place your customers in facility of your digital transformation objectives.

ai develops expert system (AI)- powered online aide items as well as infrastructure for the finance sector. Monetary establishments of every dimension utilize our software application to range proactive assistance and involvement with their customers. Vancouver, BC877-2319422aeqbanking is a specialist in experience-driven financial. They assist financial institutions and also debt unions produce a competitive benefit by providing effective as well as streamlined experiences that put your customers in center of your electronic improvement goals.

Wilmington, NC910-499-0077Apiture is a digital banking provider with a vision to create a better digital experience remedy for banks of all dimensions. Apiture's solutions consist of affordable retail and business digital experiences throughout channels. Luxembourg +352 20 33 31 80AlSego is the expert remedies carrier of selection for Secure Online Applications; Digital Improvement, Banking & Finance Digital Strategy, Software Editor Activities and a lot more.

India+ 91 120462101 0Arttha is just one of the fastest expanding innovation service providers in the mobile settlements world. They supply a one-platform service for consumer-facing economic solutions, including cards, gadgets, vouchers, lendings as well as multi-currency deals. Seattle, WA206-214-7733Arvato Financial Solutions optimizes the financial efficiency for Credit rating Unions as well as State-of-the-art clients via cutting edge Advanced Analytics as well as Behavioral Biometrics remedies.

Achieve smarter, extra relied on communications with Edge-to-Edge Knowledge. Use the power of linked tools, integrating their unique environment of technology and also proficiency with their highly-secure worldwide network. New York, NY212-739-0496AutoRek is a prize-winning reconciliation option that takes on multiple reconciliation challenges by providing data honesty, workflow as well as accurate MI. Easy to use, AutoRek eliminates the requirement for lengthy as well as error-prone manual procedures.

ACP aids loan provider enhance customer fulfillment, reduce expenses with operational performance, proactively reduce threat as well as guarantee compliance with regulations. St. Gallen, Switzerland (Global HQ) Toronto, Canada (The United States And Canada HQ) 647-479-2834Axxiome is a worldwide innovation provider concentrated on supplying digital options, getting in touch with and also IT services to the banking industry. Axxiome masters linking the gap in between legacy systems as well as modern options, driving superior business outcomes.

San Francisco, CA650-946-7793BankSight is a Consumer Engagement & Growth Platform developed especially for banks as well as lending institution. It operates on the Microsoft Azure cloud as well as leverages innovative analytics to aid lenders more wisely involve with their customers. Austin, TX512-569-3684BankingON is a mobile banking platform that gives a 5-Star experience for community-based FIs.

Provo, UT888-822-6924Comprehensive economic health solution used by virtually 800 Banks as well as Lending institution in schools and on their internet sites for staff members, clients, and community partners. Best of Show winner at Finovate, and also in over 50% of all high institutions in the U.S. New York, NY212-644-4555The AI-Powered Digital Financial System: Automates Lending.

Improves Effectiveness. Constructed For Any Dimension Financial Institution Anywhere Around the Globe. Clients include: HSBC, Popular Financial Institution, ICICI Bank, Tata Capital, Consumers Bank. San Francisco, CA650-550-4810Blend solutions banks, lending institution, and also independent home loan brokers through our market-leading digital financing system that makes the procedure of closing a lending less complex, quicker, and much safer.

Functions across all devices and networks. Work-flow based rules engine integrates Core, CIP, ID Scan, & Financing systems. Strong safety and conformity. Portsmouth, NH800-243-2528As one of American Banker's Top 100 Fintech business, Bottomline Technologies offers a vast array of digital financial solutions, including the easiest, smartest and also most protected account opening and also onboarding, incorporated with over 20 core systems.

Breach Clarity addresses every people' concerns concerning ID scams, while reducing prices and also enhancing depend on. Ann Arbor, MIClinc is the globe leader in conversational AI research as well as its application for finance. They get on a goal to press the boundaries of conversational AI, encouraging banks to supply a brand-new as well as revolutionary AI experience for their consumers.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

5 Bad Habits That People in the my state financial internet banking Industry Need to Quit

The function-rich digital solutions are constructed using thousands of features supplying FIs with the versatility, scalability, and also dexterity needed. San Francisco, CA877-720-2040DocuSign allows individuals worldwide to digitally authorize documents, authorizations, as well as agreementson any device, in at any time area. San Francisco, CA408-636-4500Their extensive collection of applications assists customers supply unforgettable, digital-first consumer experiences in an omnichannel globe.

The platform consists of multimedia programs, interactive tools, an extensive monetary behavior analysis and also far more. Shakopee, MN952-933-1223Entrust Datacard provides relied on identity and secure transaction technologies that make those experiences dependable and safe and secure. Key financial solution is Instant Issuance. Montreal, Quebec514-337-5255eSignLive is the e-signature option behind some of the globe's most trusted and security-conscious companies.

Our chatbot is educated particularly for financial, it delivers customer support as well as automatic service without a wait. Orlando, FL321-360-9003Technology and Digital Approach consultants for economic establishments who intend to stay electronically appropriate in the ever changing world of financial. Dallas, TX321-360-9003GDS Link provides durable solutions, advisory consulting, and also analytics to assist banks, credit unions, and others lenders drive development while efficiently handling danger.

Braintree, MA866-876-3654provider for financial institutions and also credit score unions, supplying Digital Financial Management services for retail, company and wealth markets. San Antonio, TX210-697-8888Harland Clarke is a leading company of top quality settlement services, multi-channel marketing campaigns, and protected data-driven lead generation as well as important communications. Lombard, IL630-691-9500Full-service digital advertising company with tried and tested success taking lending institution to the next level of brand-new member development and retention.

Professionals in millennial marketing. Aliso Viejo, CA888-992-2554A fintech business that offers cutting-edge mobile and also IT solutions to credit history unions, straightening IT, marketing as well as mobile for unrivaled participant solution. Charleston, SC843-471-2274in/ DEAL is the premier carrier to transform digital banking and also brand commitment with charitable providing. Our white-labeled remedy as well as APIs offer your customers with an unmatched giving experience.

Austin, TX888-323-9630With a portfolio of modern-day, smooth applications powered by the sector's most recognized system, Kony DBX makes it possible for financial institutions as well as credit report unions of any size to accelerate technology without jeopardizing what's crucial. Tel Aviv, Israel888-252-1440Lightico increases car loan processes. While on a phone call with a get in touch with facility agent, customers can electronically sign papers, full types, share documents/ID, as well as process payments safely all from their cellular phone.

New York City, NY917-994-8881MANTL provides market-leading account opening software program that aids financial institutions grow down payments much faster as well as a lot more cost-effectively. From consumers to complex commercial services, MANTL's products provide an exceptional experience online, on-the-go, or in-branch. San Diego, CA619-269-6800Mitek is maximizing the mobile customer experience for greater than 5,800 financial solutions companies as well as leading brand names across the world.

With AI-powered customer journey orchestration, personalization capacities, and in-built analytics, MoEngage enables hyper-personalization at scale. Miami Beach, FL855-210-7874From SmartCore, SmartDigital, as well as SmartPayments, their front runner electronic modern technology platforms, to SmartLaunch, their full-service as well as standalone electronic bank choice, NYMBUS enables banks to digitally transform their services. London, UK +44 203 743 0810 ORM is a digital company that assists organizations speed up via complexity to achieve electronic freedom. Bellmore, NY516-378-4800Parabit is a leading worldwide provider of innovative protection as well as self-service hardware and also software application solutions. Products include retail consumer accessibility control, visitor administration, electronic camera units, service desks/podiums and ATM MACHINE enhancement items. Kuwait009611697444Digital, social financial, mobility, business analytics, danger administration and conformity options dealing with the Islamic financial market. St.

We imagine, create, designer, and run electronic improvement solutions that assist our monetary solutions clients exceed customers' assumptions, outpace competitors, as well as grow their business. Kapaa, HI808-635-8098An cost effective way to involve your clients with totally free quality funds web content with their widget installed on your web site. Automatic updating, look feature, topics, web links to thorough details, customized languages, private labeling.

Beaverton, OR503-836-9551Q5id enables economic institutes to avoid fraud with a customer-centric solution to confirming a digital identification. As the leader in Proven Identity Administration, Q5id equips consumers to take control of their electronic identities. San Francisco, CA800-667-6389Salesforce allows banking providers of all sizes to open development commitment with the Consumer Success Platform, which consists of capabilities throughout sales, solution, advertising and marketing, analytics, application development, and also combination.

Their goal is simple: Develop the ideal economic calculators on the net. Johnston, IA515-554-7370SimplyFocused is an enabling innovation that leverages the power of human perception to lower friction in the process of marketing retail credit report union items by means of a tailored individual experience streamlined via a CRM and also a durable coverage device.

Firmly share online, controlled data across subsidiaries and also with partners, make data-driven choices, and also meet conformity and regulative purposes powered by real-time analytics. Miami, FL415-398-4333Strands establishes cutting-edge FinTech software that enables banks to provide tailored digital banking experiences. The Strands Financing Suite consists of a thorough set of white-label options. Tampa, FL888-901-3091COMPETE & VICTORY vs.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, sandstone properties Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

17 Reasons Why You Should Ignore b2b marketing sydney10 No-Fuss Ways to Figuring Out Your b2b market

El Segundo, CA55-UNIVOIPOffering comprehensive banking communication systems, multimedia speak to facility functionality, cloud-based joint and also efficiency tools, wheelchair applications, as well as custom-made application combination with existing service systems. Toronto, ON888-552-5585Valeyo is a business options provider for financial institutions in Canada, supplying a complete collection of offering technology as well as insurance policy associated services and products.

Wilmington, DE650-353-7636Velmie is a banking software provider with 10+ years of know-how in software application advancement and also professional solutions. With the white-label platform and also tailored technique, they provide highly-scalable, protected and certified financial products. Miami, FL888-763-2210Virtus Flow helps financial institutions as well as debt unions to simplify their processes in mins. With a no-code Digital Refine Automation platform, you can relocate to the following Digital Transformation Era.

Westborough, MA508-389-7300Virtusa is a leading worldwide company of infotech (IT) consulting as well as outsourcing services. They help increase service results for Worldwide 2000 organizations in the financial as well as economic solutions industry. Atlanta, GA678-362-0014With greenID innovation, banks can verify their consumers versus credible, worldwide data resources in seconds. New York City, NY888-444-2988Yext is the leading Digital Understanding Management (DKM) platform.

Bozeman, MT406-556-7555 Zoot Enterprises is a global supplier of advanced procurement, source and decision administration options for banks. From Information to Choice.

Mobile banking innovation puts your financial institution in the palms of your customers' handsno issue where they are. CSI's mobile banking platform supplies comfort as well as 24/7 access that constructs purposeful relationships with your retail and also commercial customersall on their preferred smart phones. Integrated with CSI's core banking system, our mobile financial application provides your bank accessibility to a customizable, user-friendly collection of attributes.

With CSI's company banking application, your bank is empowered to expand your commercial portfolio by using small company owners the ability to take their financial with them. Our company financial app brings industrial capability to our currently stacked mobile application with: Mobile approvals to handle ACH, cables and tax obligation payments Complete cable creation and also editing and enhancing Complete Favorable Pay capability Capability to regulate the privileges and also approvals of sub-users and also management of firm details Multi-check deposit Your clients expect 24/7 accessibility to your bank.

Our Net financial services provide interactive, industry-leading services that make electronic banking a breeze for you and your customers, and also enable you to build and also preserve a strong digital presence. CSI's electronic banking solutions drive earnings with a totally incorporated set of devices made to enhance how your retail and also service clients communicate with their financial resources and also your bank online.

Equip them to attain life's landmarks with CSI's personal monetary administration (PFM) software program. Integrated with CSI's mobile financial application as well as on-line banking services, our PFM software program encourages liable costs as well as conserving practices by envisioning and organizing your customers' economic information, allowing them to: Boost monetary habits by setting as well as taking care of spending plans Track their expenses as well as goal progress Imagine their monetary health at any kind of offered time Automate personal notices to manage spending beyond your means CSI's mobile financial app and also on-line banking system provide one of the most pertinent, up-to-date electronic financial modern technology that profits your bank through: Improved consumer loyalty as well as account retention Enhanced market share, mobile fostering and transaction volume Instant customer accessibility through self-registration alternatives Boosted earnings generation via marketing campaigns.

We are lenders, engineers and strategists with an entrepreneurial state of mind. We originate from different industries financial, video gaming, retail, friendliness with just one emphasis in mind: the consumer. Our interest for FinTech led us on the extraordinary journey of developing our own opposition financial institution: Fidor Financial institution, with greater than half-a-million members.

The high performance of fOS generated ingenious cooperations with lenders, sellers, telecommunications drivers as well as more, to produce groundbreaking customer-centric banks. We bring you banking, modern technology, client involvement as well as go-to-market competence through Fidor team entities: Fidor Solutions, Fidor Bank as well as Fidor Factory.

By 2021, 3 billion people worldwide will certainly be banking using electronic platforms. Accountholders significantly expect an experience that matches their digital way of life. To supply this, banks and lending institution require to use an extremely that is consistent across channels. sandstone uses With advanced digitalized procedures, banks can achieve an and increase to 37% even more annual earnings from consumers that are totally involved.

Finastra's retail electronic services aid you with the channels of your choice phone, tablet, desktop computer or wearable. Our digital options allow banks to expand services to and also through 3rd parties and also incorporate with Finastra or various other core systems. For your consumer and also business accountholders, this indicates having cutting-edge electronic services that matches their lifestyle and also allows them to bank the way they want with a * Resource McKinsey ** Forrester Modern technology fostering profile: Flexible Digital Banking For An Active Future -October 2016.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

About

The factor electronic banking is greater than just a mobile or on-line system is that it includes middleware solutions. Middleware is software program Additional resources that bridges running systems or databases with various other applications. Financial sector departments such as danger management, product growth and advertising and marketing need to likewise be consisted of in the middle and backside to genuinely be thought about a total electronic financial institution.

Over 60% of customers currently use their smart devices as the recommended method for digital banking.

This vibrant forms the basis of customer fulfillment, which can be supported with Client Relationship Management (CRM) software. CRM should be incorporated into an electronic banking system, because it gives methods for banks to directly interact with their clients. There is a need for end-to-end consistency and also for solutions, enhanced on ease and also customer experience.

One way a financial institution can improve its back end service effectiveness is to split numerous procedures into three groups: full computerized partially automated manual jobs It still isn't useful to automate all operations for many monetary firms, particularly those that perform financial testimonials or provide financial investment recommendations. The more a financial institution can replace difficult redundant manual tasks with automation, the a lot more it can focus on concerns that entail direct communication with customers.

What specifically is "electronic financial," as well as what does it mean for your financial resources? The information listed below can aid you get up to speed about what digital banking is, what it includes as well as various other brand-new terminology you may have heard in conversations concerning digital banking. You'll additionally have the ability to check out the advantages of digital banking as well as how it influences the means you financial institution today and tomorrow.

means utilizing an application to gain access to numerous of those same financial functions through smart phones such as smartphones or tablet computers. These applications are exclusive, released by the financial institution where you hold your account, as well as typically make use of the exact same login information as your electronic banking portal. Made for individuals on the move, mobile banking applications often tend to include the most previously owned banking functions, such as mobile check down payment, funds transfers as well as bill settlement.

Banks also might use their mobile apps to send out clients banking signals such as fraud detection and reduced equilibrium notifications. Here's a visual equation that summarizes (actually) electronic financial: Online Financial + Mobile Banking = Digital Financial Electronic Banking in the UNITED STATE has its origins back in the 1990s.

That Uses Digital Financial? Digital Banking Via Brick-and-Mortar Financial Institutions For clients that appreciate the capability to quit by a branch to perform some of their financial functions, brick-and-mortar financial institutions and debt unions are the all-natural options for their financial institution accounts.

On the internet banks can take different forms, all of which test the high fee, reduced return brick-and-mortar banking design. Sometimes, they might be connected with a typical brick-and-mortar financial institution, serving as its online division. Or they might run exclusively online. Extra current fintech models have actually included what are referred to as neobanks or challenger financial institutions.

With an extra streamlined, online as well as mobile-only item offering, these financial institutions can lower functional expenses and help even more individuals gain access to banking solutions, a potentially vast benefit to the underbanked as well as unbanked neighborhoods. You may find that some online financial institutions may not release loans or bank card, as a way to decrease their risk.

Little service proprietors and also start-ups can access several different online service banks developed for their requirements, putting the most effective company financial experience as close as your desktop computer or mobile device. What Are the Conveniences of Digital Financial? Digital financial offers a variety of advantages for both consumers and also company owner.

If you rely only on an online bank, you can be challenged to access your accounts need to your financial institution experience an online or mobile application failure and there's no branch for you to go to rather. For those who aren't tech-savvy, electronic banking and mobile banking apps could be a little bit much to digest.

For those taking into consideration among the numerous online banks offered, be certain to ask about FDIC or NCUA insurance. You'll desire to recognize which monetary organization an on-line financial institution is partnered with to ensure that your down payment funds are insured. If you can not conveniently find this info, you may wish to look for another online bank.